Contents:

Alternatively, you can use the plus icon at the top, select the desired transaction type and choose the project name from the Customer/Projects drop-down menu. If you prefer to create invoices outside QuickBooks Desktop, make sure to enter at least a summary of each invoice into the program so it includes the revenue in the Job Profitability reports. This is a step you can take periodically and regularly to assign the job costs.

These costs relate to the staff who will be working on a project. Calculate their rate and multiply that by the hours you’ve estimated the job. Our dedicated rate calculator helps you get a handle on employee costs and how much money your projects are making. It really would be best to create two Product Items for each of your cleaners if they’re at different rates. But if you don’t want to, you can use the Amount field like a calculator and add the two rates together. Each person should be created either as a Vendor or an Other Name, instead of an Employee.

Let us dissect the differences in job costing in QuickBooks Online vs QuickBooks Desktop Contractor and understand why you should continue to use the latter solution in a hosted environment. Once you enable the project tracking report in QBO, then you are given access to various dashboards and reports that allow you to look at your incomes and costs in various different ways. You can see the total project profitability and profit margins in a glance without having to do any extra work. You just need to click on the settings cogweel in the top right corner. From there, just click on the “Advanced” section on the left and then find the “Projects” section. Once you enable this setting, you will have access to project tracking for expenses and incomes.

5.Decide when you might possibly use the following accounts within eachconstruction stage. You’ll likely change your mind several times as you figure out what you want to track. It will be far easier to do your “brainstorming” and modifications in a spreadsheet.

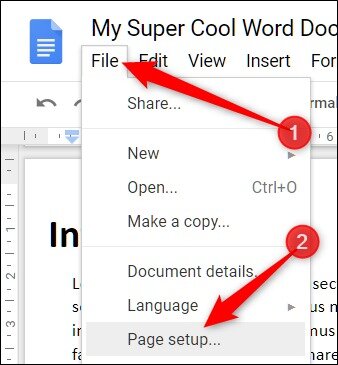

Step 3: Enter your estimates in QuickBooks Desktop

It doesn’t work for a medium or large-size construction company that has multiple quantity surveyors, project managers, and works with tens or hundreds of subcontractors. Construction processes are too specific for a general construction accounting software to be able to do all of it. QuickBooks Online does do some parts of the construction job costing process in an okay-ish way.

10 Best Growth Stocks to Buy for the Long Term – Morningstar

10 Best Growth Stocks to Buy for the Long Term.

Posted: Tue, 07 Mar 2023 08:00:00 GMT [source]

Job costing details such as profitability, estimates vs actual costs, and revenues are presented as a composition of item-based cost codes. All job-related costs are entered into items, and reports are generated using by comparing various parameters such as estimated cost vs actual cost using their cost codes. Eventually, detailed reports can be generated in the tabular format.

What is job costing?

Assign costs to a particular invoice, sales receipt, or estimate. This should allow you to view your project income, expenses, and net income for each sub-customer. This blog introduces you to 3 ways to do job costing in QuickBooks Online Plus. In case you do not have that edition, it is still okay then.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/trading_instruments.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-1.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

A delayed charge is similar to an estimate, and it can also be turned into an invoice. Reports are an essential aspect of proper analysis, and Job Costing field is no different here. QuickBooks Job Costing lets you produce advanced reports so that you can decipher task performances such as Estimate accuracy, Lost/sunk costs, Time and Mileage, Productivity and Job Status. In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option.

Determine the “primary” job phases you want to track.

With the help of QuickBooks Desktop’s Job costing feature, you can easily calculate how much amount of money you make that job and how much money you have to spend on that job. We record job costs in a manner that appears to be somewhat similar to what you suggest in this post, in that it relies on the zero-dollar concept. However, instead of creating zero-dollar checks, we record a zero-dollar GL entry each week.

- https://maximarkets.world/wp-content/uploads/2020/08/forex_trader.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/Platform-maximarkets-2.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-4.jpg

- https://maximarkets.world/wp-content/uploads/2021/06/platform-maximarkets-5.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/ebook.jpg

With projects, you can see all transactions, outstanding invoices, and profitability of an individual job. These exist on both expense and sale sides, therefore you can use them on both invoices and bills, for instance. As the result, you could set up profit and loss reports per item across your whole company.

There are also filter top 10 richest rappers in the world & their net worthss to limit the projects that you want to view in the Projects list. At the top of this page, you can see how hourly cost rates affect your profit margin. Clicking on the Hourly Cost Rate button will open a panel where you can select the rates for each worker.

This feature allows you to share bills, payments, information, and much more. Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file.

QuickBooks Unable to Create Accountant’s Copy

While it’s not specifically designed for these purposes, QuickBooks Online provides a number of feature sets that can be useful for organizing and reporting some of your crucial job data. Sub-customers are used for slightly different purposes by numerous other industries. A designer might use them to track multiple projects for a single client. A bookkeeper or consultant might use sub-customers for each of several businesses operated by the same person.

Even if the estimation of the other project was accurate, you can still use the info for the new project as a rough estimate. Job Costs by Job and Vendor Detail – Report shows a detailed list of the job-related costs you have incurred for each vendor, subtotaled by job. Job Costs Job and Vendor Summary – Report lists the job-related costs you have incurred for each vendor, subtotaled by job. Job Costs by Vendor and Detail – Report shows a detailed list of all the job-related costs that you have incurred for each vendor, subtotaled by job.

Make sure that Organize All Job-related Activity in One Place is enabled. If you don’t have a project set up, follow the directions in the next section. If you already have a project, then go to the Time Activity tab on the project’s page. You can also open a new Invoice from the New button in the left-side Navigation Pane. When you select the customer with an open estimate, it will show up in a pane on the right side.

One that does not have multiple https://bookkeeping-reviews.com/s, a lot of users, and many complicated jobs in each project. QuickBooks Online is a great piece of G/L accounting software. Since it is so popular, it is very easy to find educational materials online on how to resolve some specific issue. Especially when it comes to questions about general accounting. QuickBooks has also added different features regarding project, customer and job tracking.

However, if you’re a contractor who plans to use QuickBooks, you should exhaust your options to get as much project data as possible out of your software. Now you can create the job on which you want to track expenses and profit. Choose “Business overview” from the left-hand menu, and select “Projects.” This will display a list of all open projects and some basic details on income and expenses. I really like the process you have described for job costing when payroll is outsourced.

It sounds like maybe your Items aren’t set up correctly, or you’re missing one of the steps. The purpose is simply to move the cost from an Expense to a trackable cost. Just click the green Donebutton in the bottom right to get back to the Tag list/center. The Project Profitability report shows how much you are making or losing with the project. Using both methods, in the Customer field, you will see the customer’s name separated from the project’s name by a colon.